Digital currency management platform

We help customers in the implementation of digital currencies.

Our solutions enable global management for financial decentralized applications insuring a secure and compliant infrastructure.

Issue of digital currencies

Infrastructure management and monitoring

Our clients

Issue of currencies digital

Stable digital currencies - or stablecoins - are cryptomoney issued on blockchains and whose value is based on an underlying asset. Sceme is particularly interested in private or public digital currencies linked to bank reserves in Euro.

The digital euro benefits from the technical and functional advantages of encryption and is free from price volatility.

Sceme développe des monnaies digitales sur les infrastructures Blockchain de référence, notamment sur Tezos et Ethereum.

Constantly monitoring technological developments, Sceme evaluates the most relevant infrastructures for its customers.

Because a digital currency is built on programmatic principles, smart contracts must reflect the functionalities expected by our customers.

All our developments are reviewed or audited by independent partners.

The governance and security of digital currency procedures are fundamental to building the environment of trust necessary for their launch. Beyond these topics, Sceme also supports its customers in the operational phases related to the launch of digital currencies (key ceremony, custody).

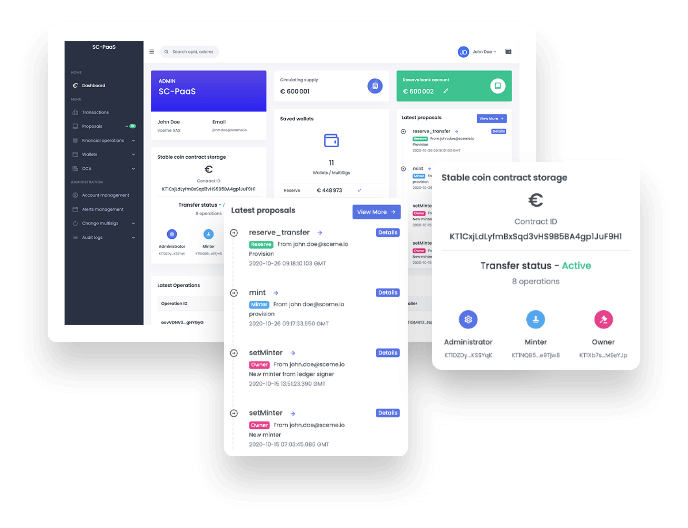

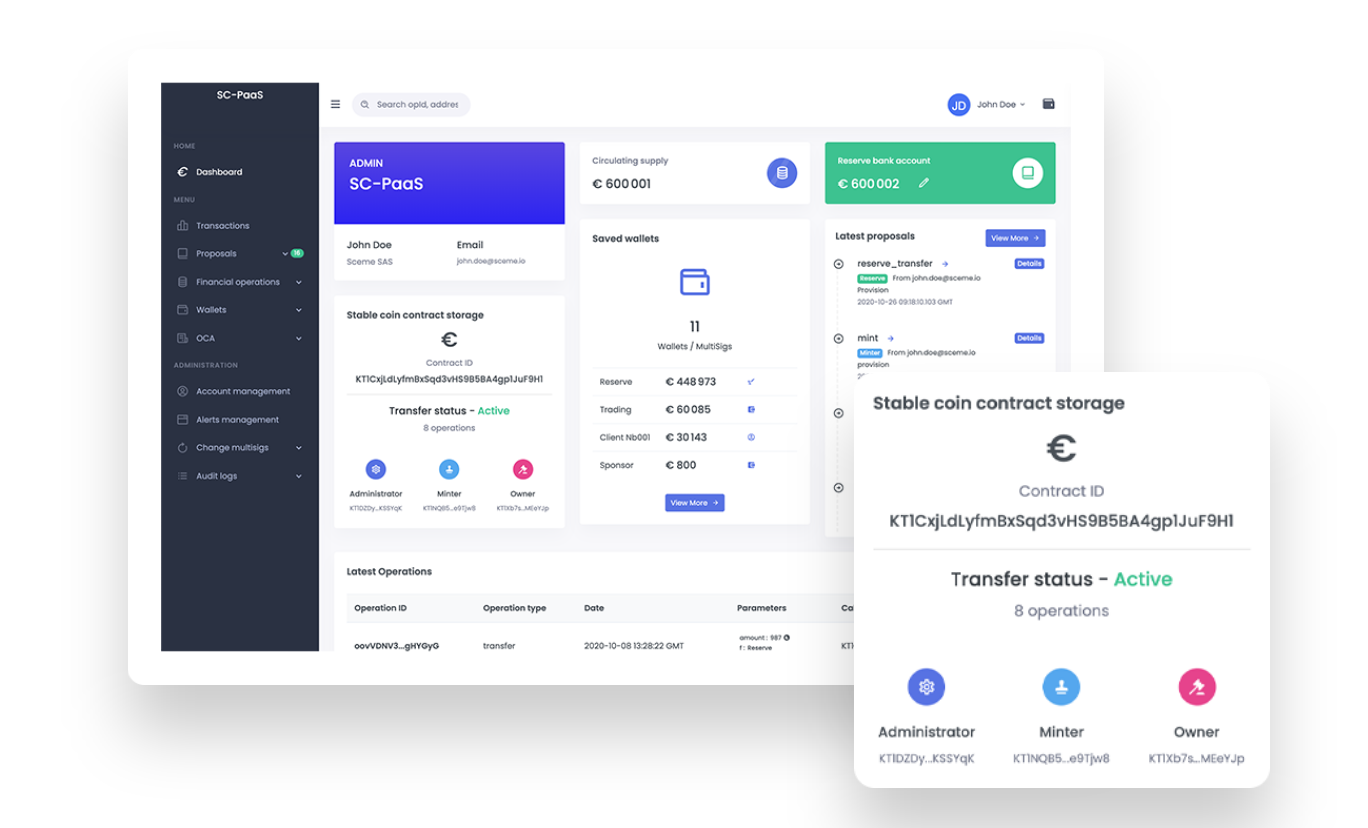

Infrastructure management

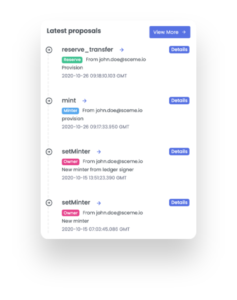

Sceme has developed a service mode platform for the piloting of digital coins. Connected to private or public Blockchains, the secure instances of the platform allow the complete management of digital currency accounts and their life cycles. It also offers monitoring tools and dashboards to track customizable KPIs.

In order to ensure a perfect consistency control between issued assets and their reserves, Sceme interfaces the banking APIs in SC-PaaS with the issue data, and ensures the alert feedbacks provided for in the governance schemes.

SC-PaaS' OCA service allows the control and publication of accounting events related to all operations and transactions of the issued digital currencies.

Infrastructure management

Sceme has developed a service mode platform for the piloting of digital coins. Connected to private or public Blockchains, the secure instances of the platform allow the complete management of digital currency accounts and their life cycles. It also offers monitoring tools and dashboards to track customizable KPIs.

In order to ensure a perfect consistency control between issued assets and their reserves, Sceme interfaces the banking APIs in SC-PaaS with the issue data, and ensures the alert feedbacks provided for in the governance schemes.

SC-PaaS' OCA service allows the control and publication of accounting events related to all operations and transactions of the issued digital currencies.

Fields of application

Finance & Decentralized Applications (DeFi & DApp)

Standalone applications, whether financial or non-financial, need payment flows based on the standards of the different chains.

Trading crypto-monnaies

The use of synthetic digital currencies has exploded in the crypto-currency market, for reasons of transfer speed and user accounting.

Enhanced payment

Digital currencies allow the portability of certified data enriching payment solutions and providing high added value for merchants (loyalty, identity).

Transparence des flux financiers (ONG, collectivités)

Systems based on Public Blockchains are assets for organizations seeking transparency of funds and financial flows.

Issuance of means of payment

Payment networks based on digital currencies will enable the creation of new payment methods with enriched functions, enabling new customer experiences. The limits of legacy systems, whether online or in proximity, are being pushed back by open, natively digital systems.

Tokenized assets / NFT

Digital currencies are the native support for clearing flows regarding the exchange of tokenized assets and non-fungible tokens.

Equipe Sceme

Articulated around professionals in digital currencies and digital infrastructures, the Sceme team, gathered around Gonzague Grandval and Jorick Lartigau, has been working on Blockchain solutions and applications for several years for financial institutions and industrial players.

Contact us to meet us and join our team!

Customer Case Study

Sceme supports Lugh launching the first digital Euro currency

For all technological aspects, Lugh profite de l’expertise de SCEME, fournisseur de l’infrastructure d’émission et de gestion de l’EUR-L.

Developed on Ethereum, Polygon & Tezos Blockchain, the EUR-L is based on strict and audited governance rules, and on permanent monitoring of funds in circulation and surveillance of the associated bank reserves.

All developments and governance rules have been technically & functionally validated by PWC.

Contact us

Par email à contact@sceme.io